Post COVID-19 Impact: “New Normal” for the Retail Sector?

6th October 2020 / Posted by Susannah WilksThe Government’s latest retail sales figures show encouraging signs of recovery since lockdown, but what do the figures tell us about the future and the most likely “new norm”?

According to planning consultancy Lichfields, the short-term impacts of the COVID-19 crisis are becoming clearer but the longer term structural implications are harder to predict. In the short term, operators have faced cash flow issues and increased costs arising from a slump in consumer demand and disruption to supply chains. Non-essential products, hospitality and leisure services have been hardest hit. Some retailers able to fulfil online orders/home delivery are benefiting at least in the short term from enforced changes in habits.

There is likely to be a longer term structural shift to on-line shopping, reducing the demand for physical space within town centres. Following the COVID-19 furlough arrangements, there is likely to be a spike in vacancies and some centres may struggle to fully recover. Some centres will need to explore opportunities beyond retail.

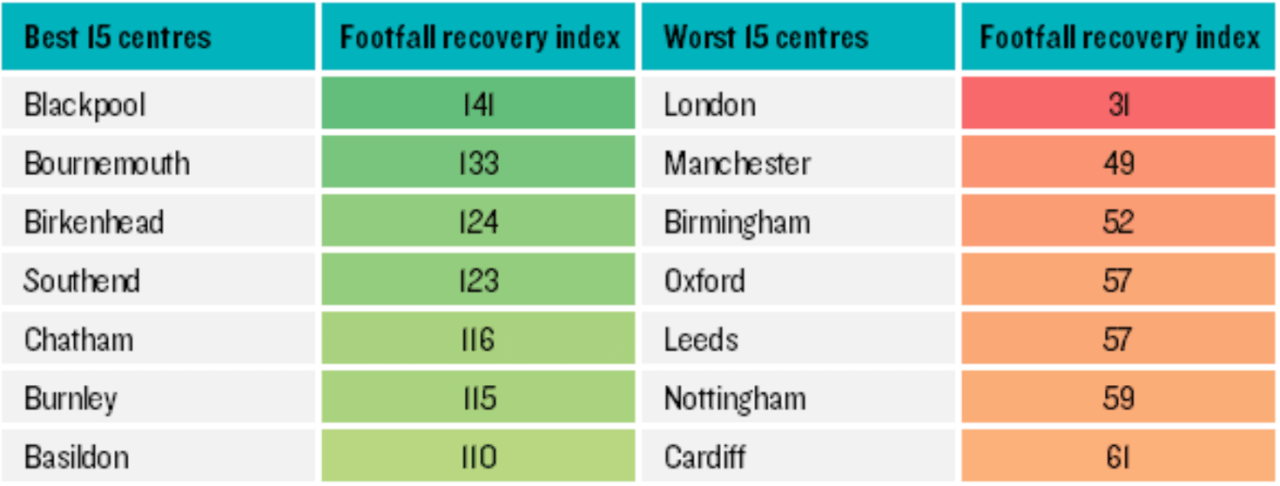

Higher order fashion shopping destinations could suffer most from the surge in online shopping. Lower order centres focusing on day-to-day essential items and services have, and should continue to, recover more quickly.

This trend is evident from the Centres for Cities’ high street recovery tracker, which monitors footfall and spend across cities and large towns. Large city centres have been slow to recover with many centres still 30% or more down on footfall and spend during the last week of August compared with pre-lockdown levels. The worst affected city centres in terms of footfall include: London (-69%), Manchester (-51%), Birmingham (-48%), Leeds (-43%) and Nottingham (-41%). These large centres have been the hardest hit due to increased home working and loss of international tourism. As a consequence of increased working from home, these headline figures for larger cities mask increased footfall within many local, district and town centres: which have seen a resurgence in footfall as people work and spend locally.

Some rebalancing from large to smaller centres will be welcomed in many areas, following the extended period of investment polarisation towards the most successful regional shopping destinations. This rebalancing could be sustained if, for example, increased home working continues. Town centres ability to retain market share and compete with on-line sales will be critical for the vitality and viability of town centres in the post-COVID-19 norm. Town centres will need a coherent recovery strategy to have the best prospects of flourishing.

For the full blog, please see here. These issues will be addressed at CRP’s next LiveShare session ‘Operating Sustainably: a North-South perspective on Transport and COVID-19‘.